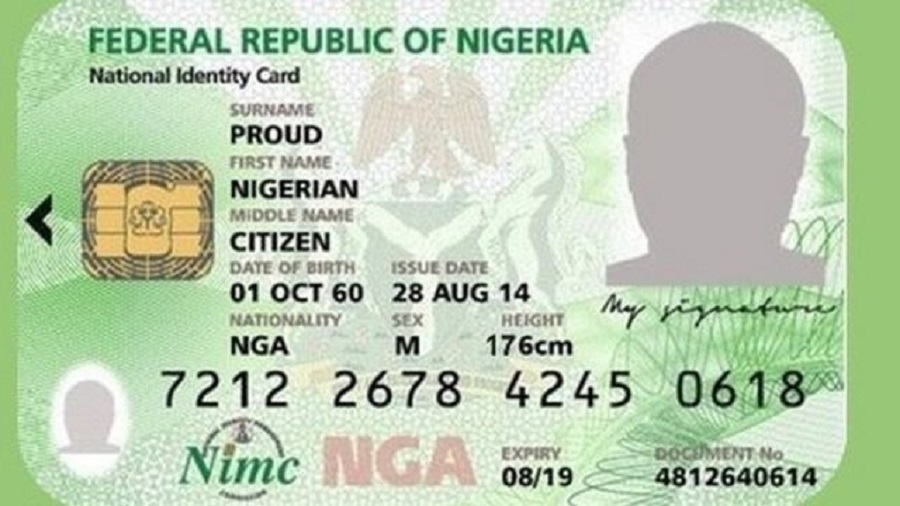

T he Federal Government has announced that investors interested in its latest financial instrument, a domestic dollar bond, must meet specific identification requirements to participate. According to the Debt Management Office (DMO), these requirements include a Bank Verification Number (BVN) and a National Identification Number (NIN) for all Nigerian citizens, including those living abroad.

In a recently released Frequently Asked Questions (FAQ) document on its website, the DMO outlined that the domestic dollar bond, issued on Monday, is part of a broader $2 billion program. The first tranche aims to raise $500 million from both local and foreign investors.

Eligible participants include Nigerians residing within the country, those in the diaspora with foreign exchange savings abroad, and foreign institutional investors. The FAQ specifies, “A BVN and NIN are required for subscription. Nigerians in diaspora can apply for both BVN and NIN if they don’t already have them.”

The DMO also emphasized that subscriptions to the bond must be made through electronic transfers, with no cash payments allowed. Payments are to be directed into designated accounts, and funds used from domiciliary accounts must have been in place for at least 30 days before the application date. Subscriptions can be made electronically or through financial institutions.

The bond is set to finance critical sectors of the Nigerian economy, as approved by President Bola Tinubu on the recommendation of Wale Edun, the Minister of Finance and Coordinating Minister of the Economy. With a coupon rate of 9.75% per annum over a five-year tenor, the bonds are accessible to both domestic and international investors, with a minimum subscription amount of $10,000—significantly lower than the typical $200,000 required for Eurobonds.

Additionally, these bonds meet the Central Bank of Nigeria’s criteria as liquid assets, making them eligible for inclusion in banks’ liquidity ratio calculations. They are also suitable for pension fund portfolios. The DMO has revealed that income from these bonds is exempt from Companies Income Tax, Personal Income Tax, and Capital Gains Tax, further enhancing their appeal.

The bonds will be listed on the Nigerian Exchange Limited and the FMDQ Securities Exchange Limited, offering liquidity to investors who wish to trade before maturity. The auction for this bond will remain open until August 30, 2024, with the settlement date, when interest will begin accruing, set for September 6, 2024.

Minister Wale Edun has stated that this $500 million domestic dollar bond will not only bolster external reserves but also contribute to stabilizing Nigeria’s foreign exchange situation.

0 Comments